How to Open a PalmPay Account in Nigeria

PalmPay is one of the leading mobile payment platforms in Nigeria, offering a wide range of financial services at your fingertips. Whether you’re looking to send money to a friend, pay your electricity bill, or simply manage your finances more efficiently, PalmPay has got you covered.

Why Choose PalmPay?

You might be wondering, why should I bother with PalmPay when there are other mobile banking options out there? Well, PalmPay stands out for a few reasons. First, it’s incredibly user-friendly, meaning even if you’re not tech-savvy, you’ll find it easy to navigate. Second, it offers rewards and cashback on transactions, which is always a nice bonus. Lastly, PalmPay is secure, with features like two-factor authentication to protect your money.

Requirements to Open a PalmPay Account

Before you jump into creating your PalmPay account, you’ll need a few things on hand:

- A smartphone (either Android or iOS)

- An active Nigerian phone number

- A valid email address

- A bank account or debit card for linking

Got all that? Great! Let’s move on.

How to Download the PalmPay App

First things first, you need the PalmPay app. Here’s how to get it:

Using Android Devices

If you’re using an Android phone, head over to the Google Play Store. Type “PalmPay” into the search bar, and once you find it, hit the download button. The app is lightweight, so it won’t take up much space on your phone.

Using iOS Devices

For iPhone users, the process is just as easy. Go to the App Store, search for “PalmPay,” and download the app. It’s quick and hassle-free.

You may like: How to Open an Opay Account How to Open an eNaira Account in Nigeria

Step-by-Step Guide to Creating Your PalmPay Account

Now that you have the app, let’s dive into setting up your account.

Registering with Your Phone Number

Open the PalmPay app and select “Create Account.” You’ll be prompted to enter your Nigerian phone number. Once you do, you’ll receive a verification code via SMS. Enter the code into the app to proceed.

Setting Up Your Profile

Next, you’ll need to fill in some basic information—your full name, email address, and date of birth. Make sure everything is accurate, as this info will be used to verify your identity later.

Verifying Your Identity

To fully activate your account, you’ll need to complete the KYC (Know Your Customer) process. This involves uploading a valid ID (like your National ID card, Voter’s card, or Driver’s license) and taking a selfie. This step ensures your account is secure and helps prevent fraud.

Linking Your Bank Account or Card to PalmPay

Now that your account is set up, the next step is to link it to your bank account or card. This will make it easier to fund your wallet and perform transactions.

Adding a Bank Account

To link a bank account, go to the “Add Bank Account” option on the app. Select your bank from the list, then enter your account number. PalmPay will verify your details, and once confirmed, your bank account will be linked.

Adding a Debit or Credit Card

Alternatively, you can link a debit or credit card. Navigate to the “Add Card” option, enter your card details, and voila! Your card is now connected to your PalmPay account.

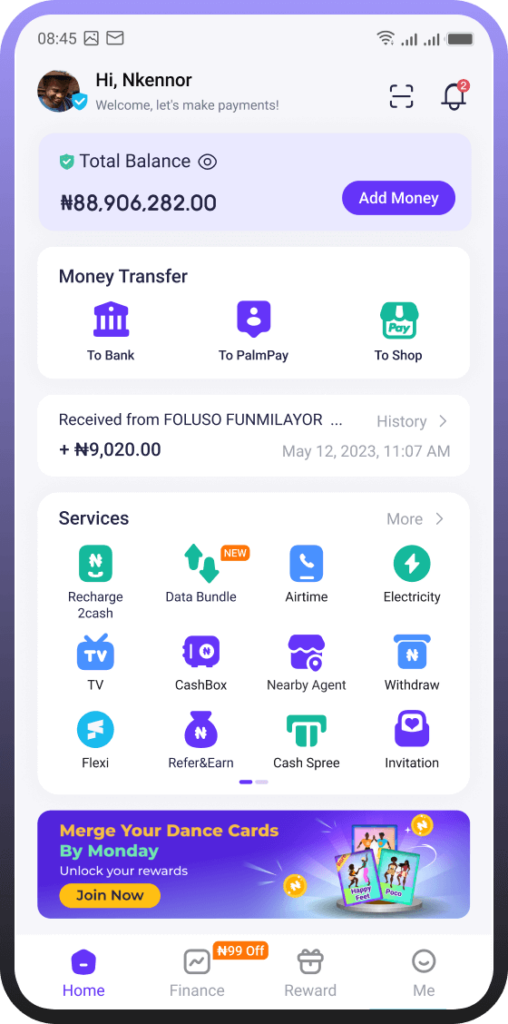

Exploring the PalmPay Dashboard

Once your account is all set up, it’s time to explore the PalmPay dashboard. This is where you’ll manage all your transactions and access the app’s features.

Navigating the Main Features

The dashboard is your control center. From here, you can send money, pay bills, buy airtime, and more. The layout is simple and intuitive, so you won’t get lost trying to find what you need.

Understanding Your Wallet Balance

Your wallet balance is displayed prominently on the dashboard. This is the amount of money you have available to spend or transfer. You can fund your wallet directly from your linked bank account or card.

How to Fund Your PalmPay Wallet

You’re probably eager to start using your PalmPay account, but first, you need to fund your wallet. Here’s how:

Funding via Bank Transfer

To fund your wallet via bank transfer, select the “Fund Wallet” option, choose “Bank Transfer,” and follow the on-screen instructions. You’ll be given a unique account number to transfer funds to. Once the transfer is complete, the money will reflect in your PalmPay wallet.

Funding via Card Payment

If you prefer, you can also fund your wallet using your linked debit or credit card. Just select the card option under “Fund Wallet,” enter the amount you want to add, and confirm the payment. It’s that easy.

How to Send and Receive Money Using PalmPay

One of the main reasons people use PalmPay is to send and receive money quickly and securely. Let’s see how that works.

Sending Money to PalmPay Users

To send money to another PalmPay user, go to the “Send Money” section of the app, enter the recipient’s phone number, and the amount you want to send. Confirm the transaction, and the money will be sent instantly.

Receiving Money from Other PalmPay Users

Receiving money is just as simple. Once someone sends you money, you’ll receive a notification, and the funds will appear in your wallet. You can then choose to keep the money in your PalmPay account or withdraw it to your linked bank account.

Paying Bills and Making Purchases with PalmPay

PalmPay isn’t just for sending and receiving money—you can also use it to pay bills and make purchases.

Paying Utility Bills

Need to pay your electricity or water bill? No problem. Just go to the “Pay Bills” section, select the type of bill you want to pay, enter your account details, and confirm the payment. It’s fast and convenient.

Purchasing Airtime and Data

Running low on airtime or data? PalmPay has got you covered. You can buy airtime or data directly from the app. Just select your network provider, enter the amount you want, and the airtime or data will be credited to your line immediately.

Taking Advantage of PalmPay Rewards and Promotions

One of the coolest things about PalmPay is the rewards and promotions. You can earn cashback on transactions, participate in promos to win prizes, and even get discounts on services. Be sure to check the app regularly so you don’t miss out on any offers.

How to Secure Your PalmPay Account

Your PalmPay account holds your hard-earned money, so it’s important to keep it secure. Here’s how to do that:

Setting Up Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security to your account. Enable 2FA in the app settings, and you’ll need to enter a code sent to your phone each time you log in. This makes it much harder for anyone to access your account without your permission.

Creating a Strong PIN

Your PIN is the key to your PalmPay account, so make sure it’s strong and unique. Avoid using obvious numbers like your birthdate or “1234.” Instead, go for something that’s hard to guess but easy for you to remember.

Troubleshooting Common Issues

As with any app, you might run into a few issues here and there. Here’s how to handle some of the most common problems.

Failed Transactions

If a transaction fails, don’t panic. Check your internet connection first. If the problem persists, try restarting the app. If that doesn’t work, contact PalmPay support for assistance.

App Not Responding

If the app isn’t responding, it might be due to a bug or a slow internet connection. Close the app and reopen it. If the problem continues, check for updates in the Play Store or App Store, as the issue might be resolved in the latest version.

Contacting PalmPay Customer Support

If you ever need help, PalmPay’s customer support is just a click away.

Via the App

You can contact customer support directly from the app. Go to the “Help” section, and you’ll find options to chat with a support agent or send an email.

Through Social Media

PalmPay is also active on social media. You can reach out to them on platforms like Twitter or Facebook for quick responses to your queries.

Conclusion

Opening a PalmPay account in Nigeria is a breeze, and it opens up a world of convenience for managing your finances. With easy steps to set up your account, link your bank details, and start making transactions, PalmPay is a great choice for anyone looking to simplify their financial life. Plus, with the added benefits of rewards, promotions, and top-notch security, there’s no reason not to give it a try.

FAQs

Yes, PalmPay works with all major network providers in Nigeria, including MTN, Glo, Airtel, and 9mobile.

While you can create an account without linking a bank, you’ll need to link one to fully utilize all the features, like funding your wallet and withdrawing funds.

If you forget your PIN, you can reset it by selecting the “Forgot PIN” option on the login screen. You’ll need to verify your identity before setting a new PIN.

PalmPay is mostly free to use, but some transactions might incur small fees, like transfers to other banks. Be sure to check the fee structure in the app.

To update your PalmPay app, go to the Google Play Store or Apple App Store, search for PalmPay, and tap the “Update” button if a new version is available.